The Biden-Harris administration is fond of marking historic firsts, but this will be a rather ignominious one. No sitting president has ever admitted to $1 TRILLION in improper payments during a single four-year term, but President Biden is on pace to do just that before he leaves office.

Federal agencies threw out over $764 billion on improper payments in fiscal years 2021-2023, or $801.4 billion after adjusting for inflation.

Barring something unprecedented, the total will cross the trillion-dollar mark by the time President Biden’s term ends. It would be a nearly $200 billion increase in improper payments from President Trump’s administration, adjusted for inflation.

That’s a lot of cash to lose between the proverbial couch cushions!

BACKGROUND

An improper payment is “made by the government to the wrong person, in the wrong amount, or for the wrong reason,” according to federal guidelines. It includes both overpayments and underpayments due to fraud, mistakes or administrative errors.

The federal government self-reported a net $235.8 billion in improper payments for fiscal year 2023.

That’s more than the entire budget of every state except California.

It’s almost $7,500 lost every second!

In the blink of an eye, the government wastes enough money for five average rent payments.

At the one-minute mark? That’s $450,000 misspent. For that amount, you could buy a median-priced home with change to spare.

OpenTheBooks reported last year that the federal government had made $2.9 trillion in improper payments between 2004 and 2022, adjusted for inflation. The total is now well over $3 trillion.

More than 10% of America’s current GDP, all spent away by mistake.

“Goodness, that was more than I thought.” – Rep. Summer Lee (D-PA) on the improper payments tally. (Washington Times)

BIDEN VS. TRUMP

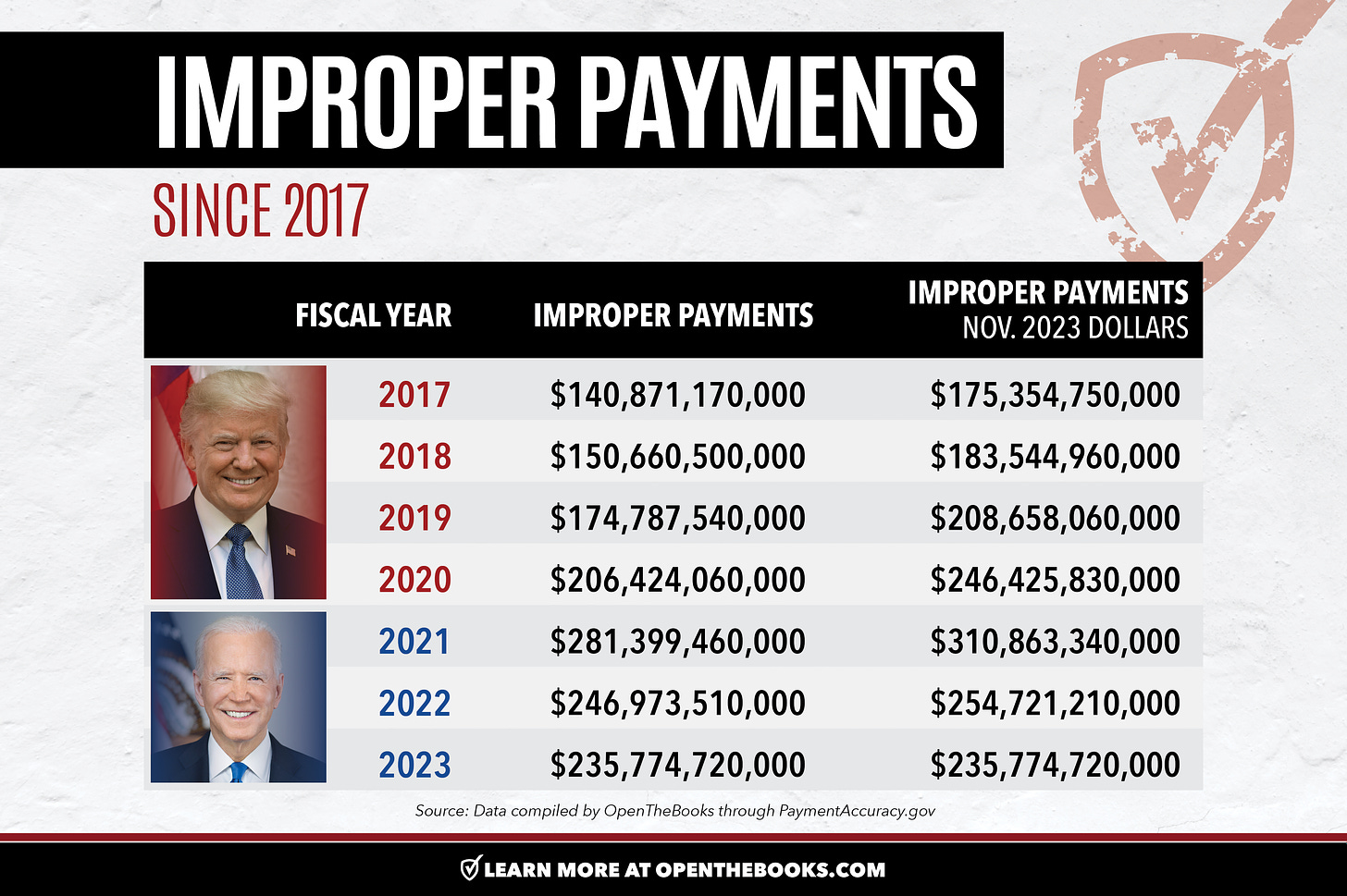

(Methodology Note: Inflation figures were calculated with November 2023 dollar values, when the latest payment data was reported).

Biden’s administration has wasted 34% more money on improper payments than Trump did during his first three years in office, even adjusted for inflation.

Trump’s administration admitted to $672.7 billion of improper payments in four years. That’s $814 billion adjusted for inflation; just barely more than Biden has reported in three years.

Rising federal spending isn’t the only culprit. In 2021, the government lost 7.16% of its outlays to improper payments, the worst rate since at least 2012. Last year it was 5.4%, which is still worse than all but one year since 2012.

At least the Biden administration’s misspending has slowed over time, following an initial spate of massive spending bills. The government’s improper payments have edged downward every year since he took office, while they increased every year under Trump.

Barack Obama’s administration spent more accurately during his second term than Biden or Trump, but 4.1% of federal money was still spent incorrectly. That’s not good enough to be the gold standard.

WHO’S LOSING MONEY?

PUBLIC HEALTH: Medicaid and Medicare accounted for nearly $101.5 billion (43%) of improper payments last year. It’s a huge increase since 2012, when the figure was $64 billion..

COVID WASTE: Mismanaged COVID programs continue to waste tax dollars. The Department of Labor’s Pandemic Unemployment Assistance ($48.3 billion) and the Small Business Administration’s Paycheck Protection Program ($18.1 billion) combined for $66.4 billion of improper payments in 2023. The most recent estimates show $1 trillion lost to fraud during the pandemic.

THE DECEASED: Dead people received almost $295 million last year, mostly because the Office of Personnel Management was paying out benefits to retirees who were long gone.

PRISONERS: Another $171 million was paid to incarcerated people who are disqualified from payments.

THE TAX MAN: Internal Revenue Service threw out $25 billion by giving erroneous tax credits, with some programs reporting a mistake rate above 30%. $546 million went to families claiming to have more children than they actually did.

Only $51 billion (29%) of federal overpayments from last year have been recovered.

There’s likely more financial errors we don’t know about. The Government Accountability Office says Congress has not given all federal programs the authority to estimate their improper payments. The GAO also believes there are undetected, “sophisticated fraud schemes” not included in the estimates.

CASE IN POINT: THE EPA’S GREEN ENERGY CASH

Some government officials saw the improper payment crisis coming as Biden continued to pump supplemental funding into federal agencies.

The Environmental Protection Agency received $41.5 billion from Biden’s Inflation Reduction Act, but none of it was spent on ensuring payment accuracy.

EPA Inspector General Sean O’Donnell told Congress in March 2023 that without “adequate resources,” his coworkers have “been unable to do any meaningful IRA oversight” to avoid improper payments.

O’Donnell also took issue with the fact that the EPA had only until the end of 2024 to spend 65% of its IRA funds.

“The pace of this spending, when conducted by newly created programs and received by new recipients, significantly increases the vulnerability of all parties to fraud and creates the potential for errors or inefficiencies in execution,” he said.

Only a small fraction of the $60 billion the EPA received from the Infrastructure Investment and Jobs Act was spent on supervision — not enough for the “robust oversight mechanism to protect American dollars” O’Donnell said was “required.”

Long story short: President Biden dumped an enormous amount of cash on the EPA in pursuit of Green New Deal-style spending, and volume and pace of the spending simply outstripped the agency’s ability to manage it carefully. More money, more problems!

The EPA’s struggles reveal two simple ways to protect taxpayer cash: slash government spending, or allocate funds at a slower pace with more checks and security measures.

BOTH PARTIES ADMIT THERE’S A PROBLEM

A bipartisan group of House members introduced the “Improper Payments Transparency Act” this May, which would require the president’s budget request to Congress to identify trends in payment errors and propose a plan to fix them.

The problem is now so glaring that even California Democrats want to rein in the spending. Reps. Jimmy Panetta and Scott Peters both cosponsored the bill along with Reps. Rudy Yakym (R-IN) and Jack Bergman (R-MI).

Read OpenTheBooks’ statement on the Improper Payments Transparency Act.

The similar “Enhancing Improper Payment Accountability Act” would require federal programs with budgets of more than $100 million per year to give more detailed and timely reports on their spending. That bill comes from a Democrat as well, Rep. Abigail Spanberger (D-VA).

Both bills advanced out of committee with 18-7 votes.

CONCLUSION

At the end of his second term, President George W. Bush attracted negative media attention when he became the first to send Congress a budget request exceeding $3 trillion dollars. Ironically, since the middle of the Bush era, we’ve spent that much on improper payments alone!

Two decades later, here we are about to cross another terrible benchmark: a trillion dollars worth of taxpayers’ money spent improperly in just a single, 4-year presidential term.

Having presided over trillions in new spending through the infrastructure deal and the so-called Inflation Reduction Act, President Biden ought to get behind some of the legislation aimed at mitigating the problem, or propose solutions of his own.

In fact, every public official and candidate must be asked what they plan to do about this crisis.

FURTHER READING

Duplication Nation: How Congress Saved Taxpayers $670 Billion with 1,341 Cuts to Programs Since 2011 | OpenTheBooks Oversight Report | www.openthebooks.com.

Biden-Harris Admin on Track to Oversee $1 Trillion in Improper Payments, Watchdog Group Finds | Robert Schmad | Daily Caller | www.dailycaller.com

Biden Administration on Track for $1 Trillion in Improper Payments | Stephen Dinan | Washington Times | www.washingtontimes.com

Biden-Harris Admin Set to Top $1 Trillion in Improper Payments, Watchdog Warns | Spencer Lindquist | Daily Wire | www.dailywire.com

OpenTheBooks is a project of American Transparency, a 501(c)(3) nonprofit.